Contents:

- USD/JPY

- Market Forecast: Currencies Talking Points: PMI & NFP Data Releases: OPEC+ OIL Output Shocker

- NFP Contest Win Gold Bar – Lirunex

- Gold Price Forecast: XAU/USD looks to NFP to decide if it is the time to test recent highs near $2,000 – TDS

- What does it mean if the non-farm payroll data is higher than what was expected?

Therefore, traders of the forex market must analyze and study the NFP report of past and recent for predicting the trade. If traders understand how to trade NFP and make use of the report, they can earn high profits in the uncertainties of the forex trade. The forex market is volatile and has high liquidity, which makes it full of opportunities and risks. So, traders have to be careful while investing in such a market.

Gold finds relief as dollar rally pauses – for now – FOREX.com

Gold finds relief as dollar rally pauses – for now.

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

For example, they will help you structure your trading schedule while offering you the chance to profit from massive market moves. On the flip side, the other popular method of trading the NFP report is called the short-term news. It involves examining whether the NFP is better or worse than expected or does the NFP refutes or confirms market expectations. This is why many analysts, funds, traders, investors, and speculators anticipate and predict the NFP number and the directional movement it will cause.

USD/JPY

To help assess and forecast how economies are performing (e.g., if you want to know what percentage change there has been in jobs since last month). This monthly economic indicator has all the beginners googly-eyed. This website includes information about contracts for difference , cryptocurrencies and other financial instruments offered by brokers, exchanges and other entities offering such instruments. This inside bar’s high and low rates set up our potential trade triggers.

“A decision has not been made” – Fed Chair Jerome Powell’s attempt to soothe market worries about a potential 50 bps hike in two weeks has only raised expectations for the upcoming report. It isn’t unheard of or unusual for the EUR/USD to move thirty pips within the first couple of minutes after the report’s release. And the more prominent this initial move, the better it usually is to establish the pair’s direction. As a trader, you need to establish criteria to enter and exit and the position size you would like to trade. An excellent example of finding the trade setup may be to use thirty pips.

Market Forecast: Currencies Talking Points: PMI & NFP Data Releases: OPEC+ OIL Output Shocker

The inside bar’s high and low are used again for a second trade if needed. Increasing numbers may show economic expansion but may also give investors reason to be concerned about inflation and decreasing numbers suggest a broader economic concern. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

Week Ahead Preview: Highlights include NFP, ISM, RBA , RBNZ, BoJ Tankan, BoC BOS – ForexLive

Week Ahead Preview: Highlights include NFP, ISM, RBA , RBNZ, BoJ Tankan, BoC BOS.

Posted: Sat, 01 Apr 2023 22:00:00 GMT [source]

In addition to central bank events and interest rate decisions, they are probably the most-watched Forex news items. However, their impact seems to be diminishing over the past few months. Trading the NFP data release can be risky owing to increased volatility and potential spread widening. To avoid being stopped out, we recommend applying the right leverage, or none at all. We propose adopting a pull-back strategy rather than a breakthrough approach because to the volatility nature of the NFP announcement. Before entering a trade using a pullback technique, traders should wait for the currency pair to retrace.

NFP Contest Win Gold Bar – Lirunex

In this example, the https://g-markets.net/ expectation was for 160K new jobs to be created in the prior month. The actual result came in below expectations, which was, therefore, negative for the USD. The most effective strategy for trading the NFP report is to combine a combination of both technicals and fundamentals. There is also the need to factor in what the report will mean for underlying interest rates in the US. Conversely, if the expectation going into the NFP report was for 300K new jobs to have been created in the last month and the actual result was 200K, then that would be seen as a negative. When jobs are created, that helps put pressure on employers to raise wages which in turn, gives workers more money to spend.

In most cases, it is better to track the trend of the NFP numbers than the figures themselves. Economic analysts and investors use this report as an important indicator of where the U.S. economy may be heading. NFP (Non-Farm Payrolls) is data released by the Bureau of Labor Statistics every year. It can also be useful to backtest your strategy, by going back over historic price data and seeing how your NFP strategy would have worked in the past if you had used it. Note what would have gone right or wrong and adapt your strategy accordingly. In the next section, we will take a closer look at how to create an NFP trading strategy using an OCO order.

Waiting for the market to digest the information is the logic behind the strategy. Participants will trade in the direction of the dominant momentum once the initial swings are over and after they have had some time to reflect on what the number means. The NFP influences oil, gas, and energy demand as an economic indicator. Home, industry, work, and travel use more energy when the report is positive.

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

All currencies traded against USD are affected by NFP, such as EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCHF, USDTRY, etc. Usually, major forex pairs and exotic and minor currency pairs that are US dollar crosses will be affected by NFP (Non-farm payroll). Non-farm payrolls or NFPs are an aggregation of jobs within the non-farm payroll classification designated by the Bureau of Labor Statistics.

What does it mean if the non-farm payroll data is higher than what was expected?

Thus, generating revenues and boosting the purchasing power of traders. A significant report for all the major trading factors that indirectly impact the forex trade. The Non-Farm Payroll is a report published by The U.S Bureau of Labor Statistics that shows the monthly changes in U.S. jobs, excluding farm-related employment. This exclusion comes from strong seasonal tendencies in the agricultural sector that would skew the numbers at certain times every year, rendering the report less useful. Along with the Federal Reserve interest rates decision and the gross domestic product projections, NFP is one of the strongest price drivers of the US dollar. As you can see, the increase in volatility could stop a trader out of their position.

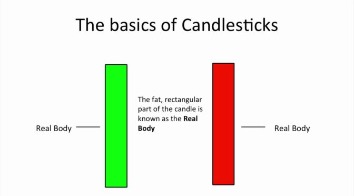

After-hours trading refers to the buying and selling of stocks after the close of the U.S. stock exchanges at 4 p.m. This avoids jumping in too early and decreases the probability of being whipsawed out of the market before it has chosen a direction. Technical analysis can be employed in the NFP report using 5 or 15-minute chart intervals.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

These statistics affect the market for foreign exchange, bonds, and stocks. It’s a sign the US economy isn’t growing if the non-farm payrolls report shows a decline of under 100,000 jobs. Forex traders will therefore favour currency pairs with higher yields against the US dollar. And finally, on Friday, we will get a glimpse of theUS unemployment,and nonfarm payroll data.

As such, the what is nfp forex payroll is viewed as a key indicator of the health and productivity of the US economy in general and the labour market specifically. Learn how to trade this move without getting knocked out by the irrational volatility it can create. If unemployment drops or manufacturing payrolls increase, currency traders may side with a stronger dollar. The US dollar is likely to lose value if the unemployment rate increases and manufacturing jobs decline.

As a result, foreign exchange traders and investors look for a positive addition of at least 100,000 jobs per month. Any release above—let’s say 200,000—will help to fuel U.S. dollar gains. Another essential job data monitored is the industry sectors where significant job growth or losses. For example, more people will be hired if the housing sector is poised for growth. The average hourly compensation is also closely watched since some companies may prefer to decrease the wages instead of dismissing employees as it has the same financial effect.