Contents:

As an example, the spread on EUR/USD can be as low as 0.2 pips. CMC Markets offers spreads on major forex pairs starting from 0.7 points. Clients can sign up for an FX active account, which allows them to access ultra-tight forex spreads as low as 0.0 pips . The platform is a well-known Canadian broker with an office in downtown Toronto. The platform allows clients to trade not only 330 forex pairs but also more than 10,000 financial instruments.

- CMC Markets also supports the trading of CFDs with stocks or indices as the underlying investment.

- As of November 2018, FXCM demands different withdrawal fees when you draw incomes out by wire.

- It’s interesting that there’s also a decent selection for traders with regard to order execution.

- We have participated in the live trading webinars several times and found them very interesting.

The actual fact that the broker doesn’t actively advertise a bonus doesn’t necessarily mean that no customer has the chance to receive a bonus on the primary deposit. It’s interesting that there’s also a decent selection for traders with regard to order execution. 77% of retail investor accounts lose money when trading CFDs with this provider. 71% of retail investor accounts lose money when trading CFDs with this provider.

FX Traders’ 2010 CHOICE AWARDS

In case of technical issues a representative pays immediately attention to your request. I would have appreciated if FXCM would send daily and monthly reports about the performed trades, but that is a nice to have and not a must. National Bank’s InvestCube is similar to a robo-advisor that automatically rebalances your portfolio into various ETFs. InvestCube requires a $10,000 minimum balance, and charges an annual rebalancing fee of 0.3% to 0.5%. If you’re between the ages of 18 and 30, you can qualify for Qtrade’s young investor pricing if you set up an automatic pre-authorized deposit of at least $50 per month to Qtrade. This gives you access to $7.75 commissions, a discount from the regular $8.75 commissions, plus no account minimums and admin fees.

- 71% of retail investor accounts lose money when trading CFDs with this provider.

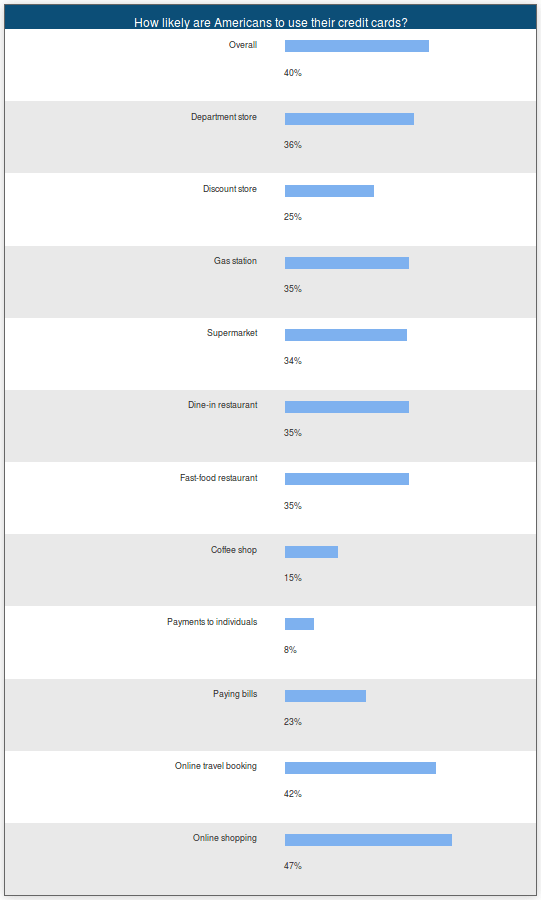

- One feature that Canadian forex brokers offer that bank brokerages do not is the ability to make credit card deposits and withdrawals.

- For certain registered accounts , the annual account fee of $100 is charged if your account balance is $25,000 or less.

- When opening a Standard account with FXCM, a minimum deposit of £5,000 would be required.

FXCM customers can take advantage of a diverse range of products, since the company offers trading not only in Forex, but also in precious metals, shares, indices and cryptocurrencies CFDs. FXTM offers trading via Metatrader 4, Trading Station, available for Mac, Android, iOS and web and also Social Trading via ZuluTrade, all tailored to the individual needs of their clients. With 20 years of supplying trading accounts and services to thousands of traders around the world, FXCM seems to have their fair market share. Scam brokers will often operate a single bank account for both their clients’ funds as well as their own operational money. This means that when funds are dwindling on their accounts, they will be more likely to seek ways to boost operations using client money.

NSBroker vs FXCM: The Verdict

FXCM offers a limited selection of about 85 assets to trade, including Forex, indices, stocks, commodities and cryptocurrencies. Some brokers manipulate their trading platforms to always be at the disadvantage of traders. This can come in the form of negative slippage, where entry and exit orders are filled at prices undesirable to the trader. For instance, a buy order is filled at a much higher price, which limits the eventual profits that can be realised on the trade, if any at all.

For instance, your bank account is funded in the USD and you prefer receiving money at the UK or US-based bank, the fee is regulated at $25. In a meantime, it costs you $40 if your receiving account lies outside those jurisdictions. Besides the given trading fees, you should consider other charges as well. If you choose swing or position trading styles, overnight funding is charged as per the broker’s policy. In the case of financing your trading account, no deposit fee is incurred regardless of payment methods.

GLOBAL FOREX AWARDS 2021 Best Forex Mobile Trading Platform – GLOBAL

Spreads on forex trading are as low as 1 pip (in this case, for EUR/USD). Keep in mind that this spread is ten times higher than the lowest spread offered by Interactive Brokers. The brokerage offers you direct access to interbank quotes, with real-time quotes from 17 of the world’s largest forex dealers. As with other platforms, only accredited investors from the province of Alberta can trade forex through Interactive Brokers. FXCM can be considered by most traders as the “grandfather” of Forex brokers, along with the others who were later listed on the New York Stock Exchange in 2001. With that said, this review may help you reach a suitable trading partner for your goals and experience.

In most cases, traders will rely purely on technical analysis to try and predict which way a currency pair will move. Staying an industry leader in a fast-moving, competitive environment such as forex can be a challenge. As a testament to a tireless dedication to the customer, FXCM is widely recognised as a premier brokerage for both retail and institutional clientele. This is accentuated by a long list of awards and accolades for provision of brokerage and trade-related services. Trade your opinion of the world’s largest markets with low spreads and enhanced execution.

We use dedicated people and clever technology to safeguard our platform. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. I find the FXCM trading station platform of excellent performance and efficient to use without any problems. As we strive to excel in our industry, we are honored to have clients like you. If there is anything more for which you may require our assistance, don’t hesitate to contact us. I’m resident in the United Arab Emirates and we don’t have tax here in the UAE.

CIBC https://forex-reviews.org/ one of the lowest fees for assignments and exercises of option positions, with the fee for auto assignments being just $6.95 plus $1.25 per contract. There are 100 ETFs that can be traded commission-free, and this includes many iShares, Vanguard, Horizons, and Desjardins ETFs. In order to qualify for commission-free ETF trades, you’ll need to hold the eligible ETF for at least one business day. If you are considering other trading options in Canada, make sure to read my guide outlining the best day trading stocks in Canada for some excellent alternatives.

This means that their investors will almost always end up losing their trading capital before getting a chance to withdraw any profits. That is, traders only need to place a little margin with the broker to control a much larger position in the market. This effectively means that profits on successful trades are amplified. But herein lies the danger of leverage – losses on unsuccessful trades are also boosted. Oanda charges lower financing costs when compared to margin interest rates at some Canadian brokerages.

Experience has shown that customer service is quick, so traders do not have to wait long for an answer. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. No Rollover fees campaign makes FXCM easily the best CFD broker. I saved over $10,209 in rollover fees trading with FXCM for almost 2 years now. It makes a massive difference in these rough markets where instead of 5% P.A for overnight holdings you are paying 0%.

For better trading performance, it provides advanced indicators including Real Volume and Speculative Sentiment Index to help you in approaching real-time market data. As of November 2018, FXCM demands different withdrawal fees when you draw incomes out by wire. Depending on the location of your local bank, the charge will vary.

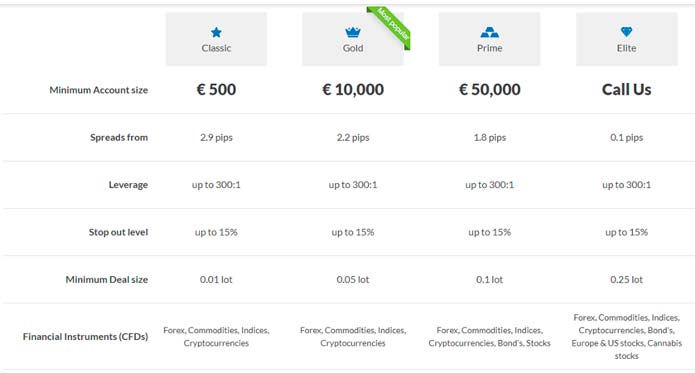

Accounts

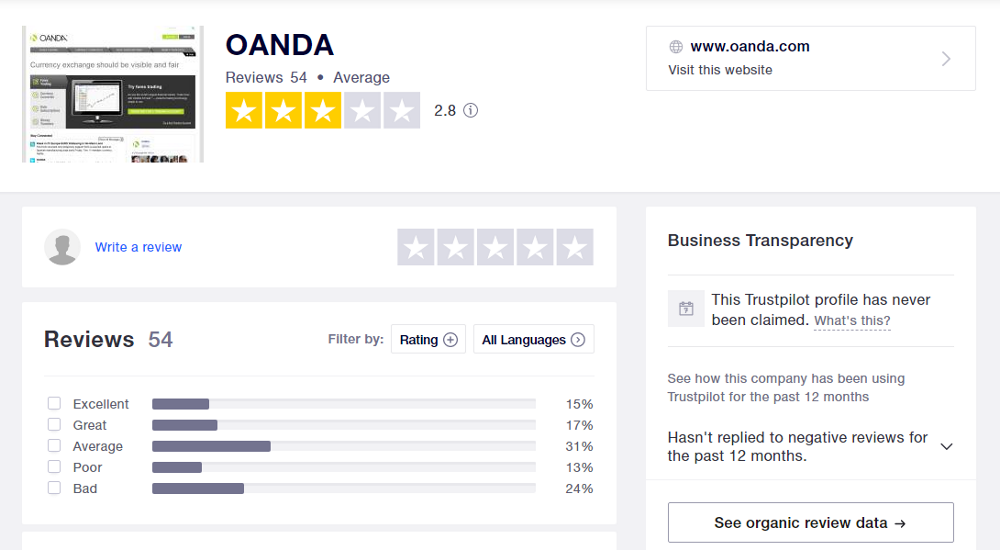

fxcms should assume that FXCM Canada is a good and reputable broker. However, we generally recommend not only looking at the overall rating, but also reading through the ratings in detail. In our review of FXCM, we share with you what we have discovered about the broker. Award-Winning BrokerSince 1999, FXCM Group has been on the leading-edge of the forex market. It’s great to hear that you are enjoying FXCM, and if you ever want to share any further feedback, we’d love to hear you out.

The V.I.P. account features tighter spreads and commissions as well as some of the best ECN conditions and account manager access. No matter whether you would like to fund or withdraw, NSBroker offers a modest number of methods including credit/debit cards , bank transfer, Skrill and Netller. In a search of reputable forex brokers, you might be surrounded by advertisements about the countless number of mediators and dealers.

In addition, the company imposes tighter spreads and low commissions which are its main income. This renders you less prone to widened spreads when the market becomes volatile. The commission is fixed at $8 per lot for most instruments, whereas that of cryptocurrencies and indices is 0.5% and 0.05% of the position size in a given order. When it comes to tradable markets and assets, both FXCM and NSBroker end in a draw. However, NSBroker dominates FXCM in the number of financial offerings, particularly 100+ versus 60+.

Best Spread Betting Platform UK in 2023 – InvestingReviews.co.uk

Best Spread Betting Platform UK in 2023.

Posted: Tue, 04 Apr 2023 13:54:41 GMT [source]

Further, forex currency pairs are the main contributor at both brokerages with the figure of approximately 40 instruments. Minimum deposit – Opening a trading account with FXCM can take some time. The whole process, from filling in the online forms to have the account approved, can take 1-3 business days.